What is A constant Income & Why does They Apply at The Home loan?

What’s a stable income as well as how does it affect your own home loan?

Very, you’re thinking about to find property and you also need to take out a home loan. After you make an application for a home loan, you’ll want to prove that you are able to afford the fresh new month-to-month mortgage money and you decide to afford the cash return.

You will have to meet with the money conditions to the mortgage and you can section of that may are demonstrating that your particular money is stable and you may normal.

It’s a good idea to check out how much you can afford to North Carolina loans borrow using a financial calculator before you speak to lenders, but remember, it’s only a guide and not a firm mortgage offer.

Obtaining a home loan your income number

- How much can be your earnings? Do you really pay the mortgage?

- What are their outgoings labeled as your debt-to-earnings ratio (DTI)?

- Can be your money steady? Do you receive the same count regularly in the same supply?

- What’s your credit rating like?

- Are you currently thinking-working and does your earnings fluctuate? Do you have a-two-12 months reputation for thinking-a position proving that earnings try steady or ascending?

Trying to get the loan money verification

Once you submit an application for a home loan, you’ll want to establish your revenue. If you are during the typical a job, it is possible to accomplish that giving the lending company enough their recent payslips along with your most recent W-dos means. You may need a letter from your company, particularly when you have been on your own occupations for under a couple decades, and can also request the past a few years’ government income tax productivity right from the latest Irs.

But there is however more in order to they than just appearing your income. You may be inclined to help you safe a mortgage for individuals who is reveal that your earnings was secure, and it is important that you has a constant income particularly during the the full time regarding obtaining the mortgage. The employment disease you will alter after you have signed on your financial, but so long as you can also be still pay the mortgage costs, don’t find dilemmas.

What are the income conditions to own a mortgage?

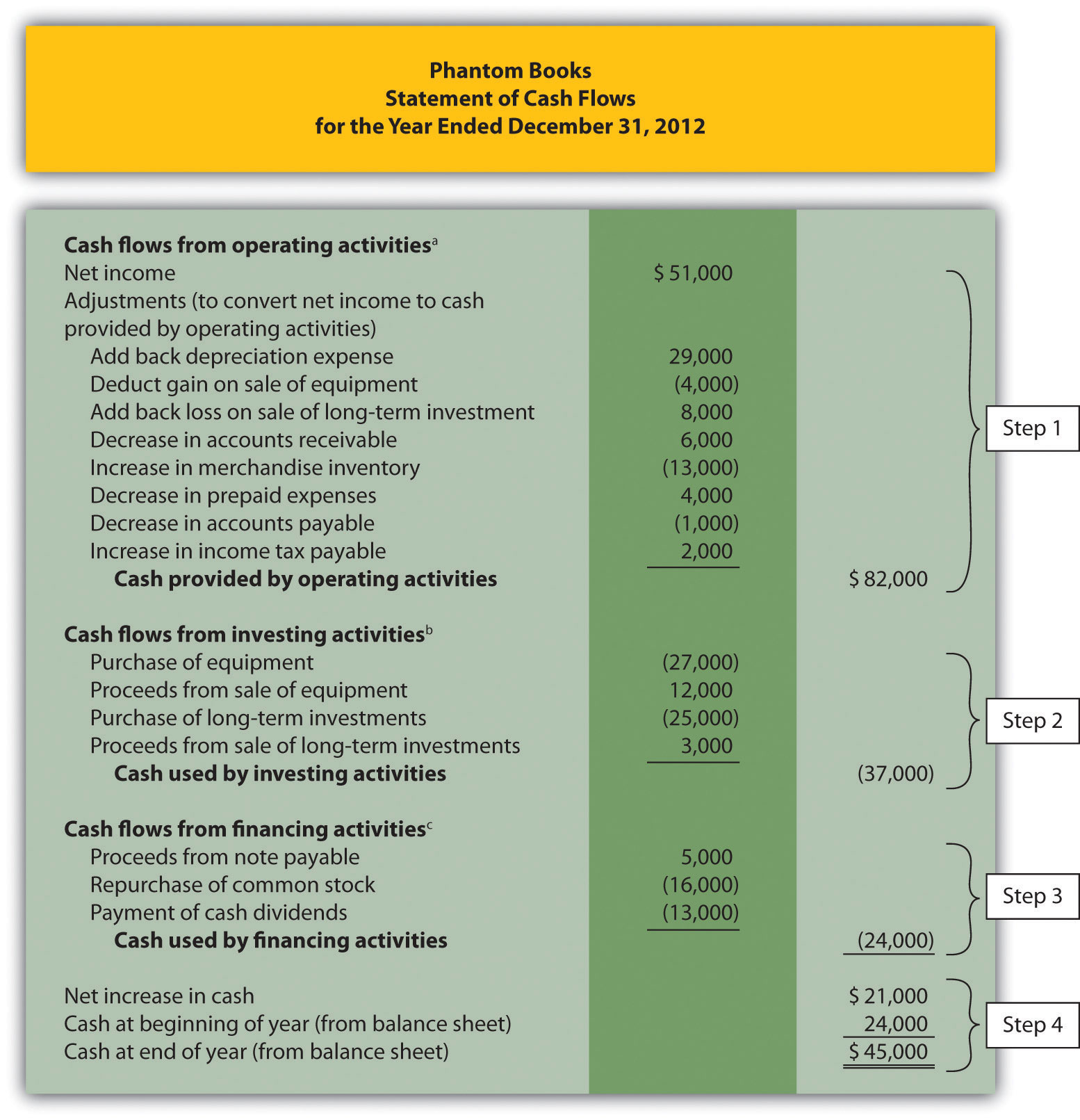

Some other loan providers keeps other criteria as well as, it depends precisely how far you have made and how far you want to obtain. But a frequently-quoted rule is the fact your monthly home loan repayments, and additionally assets taxes, together with homeowner’s insurance coverage, really should not be more 28% of your own revenues.

For people who include almost every other debts (handmade cards and you will auto loans, particularly), your own complete outgoings still shouldn’t be more than 36%. This will be called the debt-to-money ratio or DTI.

It is really not devote brick even in the event if for example the credit rating is truly an effective, or you have an enormous downpayment, including, particular lenders shall be flexible, and there also are debtor software that don’t embrace the quality money standards for a financial loan.

It might let for those who have a great existing experience of a certain bank when you sign up for your financial. If you’re able to let you know you’ve came across all your valuable money to your an effective earlier in the day home loan or financing, or if you enjoys a recent account together, they could take this into account. To put it briefly talk to your lender to ascertain how much you will be accepted in order to borrow.

What’s a stable income?

Into the financial words, a steady earnings is described as money which is paid-in a set otherwise fixed number from the same source into the an excellent consistent basis. Instance, payslips out of your workplace will teach that you receive a typical income source.

دیدگاه خود را ثبت کنید

تمایل دارید در گفتگوها شرکت کنید؟در گفتگو ها شرکت کنید.