Positives and negatives away from family security loans

- Debt-to-earnings ratio (DTI): This is why the majority of your month-to-month earnings the debt costs (such as the new house guarantee mortgage) fill up. Might usually you need a DTI of forty-five% or lower.

- Loan-to-really worth ratio (LTV): Your own LTV is how the majority of your house’s really worth the funds account for. Very loan providers assists you to has anywhere between an enthusiastic 80% and you will ninety% LTV-definition your property equity loan and main mortgage can be membership for no more ninety% of your own residence’s worth.

- Equity: Guarantee is the difference in your own home’s worth plus mortgage equilibrium. We provide a requirement with a minimum of 10% in order to 20% guarantee to qualify for a home collateral mortgage.

- Credit score: You will need no less than a good 620 get to qualify, regardless if Harmon claims specific loan providers like a good 700 or even more.

Even when criteria are different, basically, lenders are searching for a reduced financial obligation-to-earnings proportion, a good credit score, and you may an established payment background-and an acceptable percentage of equity of your house, says Rob Heck, vice president of financial at the Morty, an internet mortgage broker.

Just like the per bank features its own requirements, mortgage factors, and you can fees, you really need to contrast no less than a few options to see which your qualify for and you can what is actually available to choose from.

Shopping around is vital right here, Heck states. There can be an array of offerings, and examining banking companies, credit unions, and online organization is always to make you a good sense of what is out there.

Frequently asked questions

Domestic collateral loans certainly provides gurus. It get you an enormous lump sum payment of cash when you need it, and you may use the financing for your objective.

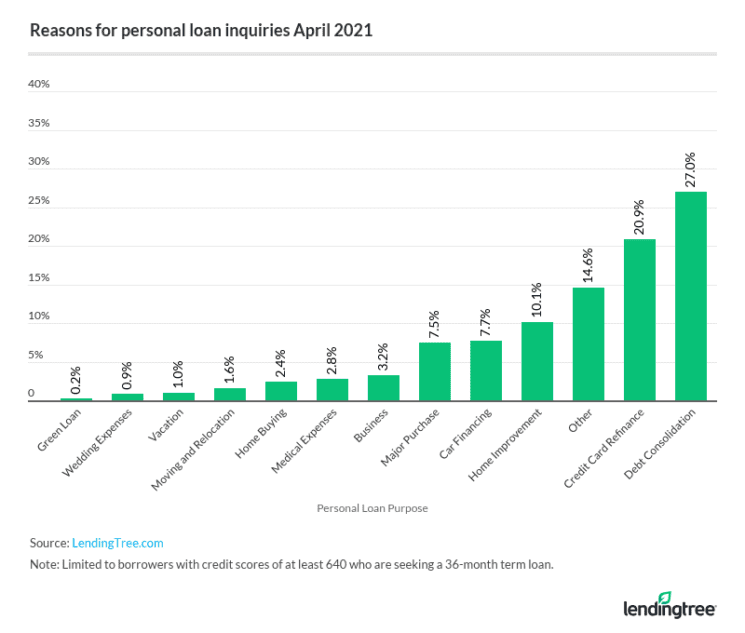

The advantage of property collateral mortgage is you can use the money to possess some thing-whether it’s purchasing a renovation or something like that entirely unrelated, such as for instance a down payment for the a car or truck, having a married relationship, or medical expenditures, Hell states.

Such fund are available with uniform, credible money minimizing rates than other borrowing products. In many cases, the eye throughout these fund can even feel income tax-allowable.

For the past few years, house security reaches checklist highs, making it a possible useful choice to utilize, Heck states. Utilizing a home security financing is a great window of opportunity for of several individuals to borrow most money on less speed than you might rating having something similar to a personal loan otherwise charge card.

Regardless of this, home equity fund are not fit for someone. For 1, they place your family on the line. Because your home is made use of once the guarantee, you might be foreclosed towards the if not make your repayments.

Addititionally there is the risk, would be to home prices decrease in your neighborhood, that mortgage balances will provide more benefits than your house’s well worth. It is entitled getting ugly on the home loan.

You might be leverage security of your house, but including an additional percentage from the a high rate, Harmon says. In the event your family worth goes down, could result in due loans in Blende more than your home is worthy of.

What’s the difference between property security loan and you can a HELOC?

Domestic security loans and you may HELOCs-or household equity lines of credit-are comparable, but not slightly an equivalent. When you are one another enable you to borrow against your residence collateral, you will find several secret variations.

That have house equity finance, you get a lump-share payment. Then you pay the bucks via fixed monthly payments more than an enthusiastic stretched several months (around 3 decades, in some instances).HELOCs, as well, give you a credit line to get out-of, the same as a charge card. After that you can withdraw money as needed for another 10 approximately many years. Interest rates become variable for the HELOCs, which means that your rate of interest and you may payment changes over time.Property security mortgage is a good selection for people that appeal the fresh structure out-of a fixed speed and you may a set payment plan, whenever you are good HELOC contains the freedom to make use of finance as required.

دیدگاه خود را ثبت کنید

تمایل دارید در گفتگوها شرکت کنید؟در گفتگو ها شرکت کنید.