What’s the Fannie mae HomeStyle Recovery Financing?

In some instances, a home customer finds out property that they understand within hearts could be good for them, if you don’t for many high priced fixes they will need to make so you can bring the house or property to habitable requirements. Possibly, renovation is the just procedure reputation anywhere between a house and you can a good dream family. To get a beneficial fixer-top can help to save property buyer loads, but sourcing the money to-do the desired performs is going to be very tough.

The pain sensation is not just considered because of the homebuyers often. Property owners who possess set up a little while within belongings, but are passing away to upgrade have it exactly as hard. Both home owners find themselves in the best household, without that awful home from the 50s.

Definitely, getting a homeowner, there are many really-identified choices in the industry having when they need to renovate their homes, for example home collateral financing and domestic security credit lines. However, utilizing equity, when you are beneficial, are going to be somewhat bothersome sometimes. Anyway, having an alternative choice that enables homebuyers and you will residents alike the fresh new opportunity to treatment or upgrade a property that they desire to buy or currently individual would not maybe harm, correct?

Which is the reason why this new FHA 203(K) financing has become while the popular as it’s now. This new FHA’s answer to this new rehabilitation/renovation problem lets consumers to obtain or re-finance a home loan having most continues put into handle the expense of renovations otherwise repairs. While it’s hard to refuse this new amazing benefits regarding FHA loans, specific home buyers perform still will has actually an alternative you to definitely will not is compulsory financial insurance policies payments and some of the almost every other drawbacks one to stem from FHA-covered funding.

For those homebuyers and you can people, luckily, there clearly was a traditional provider. The Fannie mae HomeStyle roster of financial items try a highly aggressive alternative to FHA covered loans. Particularly, this new HomeStyle Restoration mortgage ‘s the antique replacement for brand new FHA 203(K) mortgage, in this it gives residents and you can homebuyers a fund choice that allows to possess renovations and you can fixes to be built to a good possessions, all the if you are leftover reasonable and simple so you’re able to qualify for.

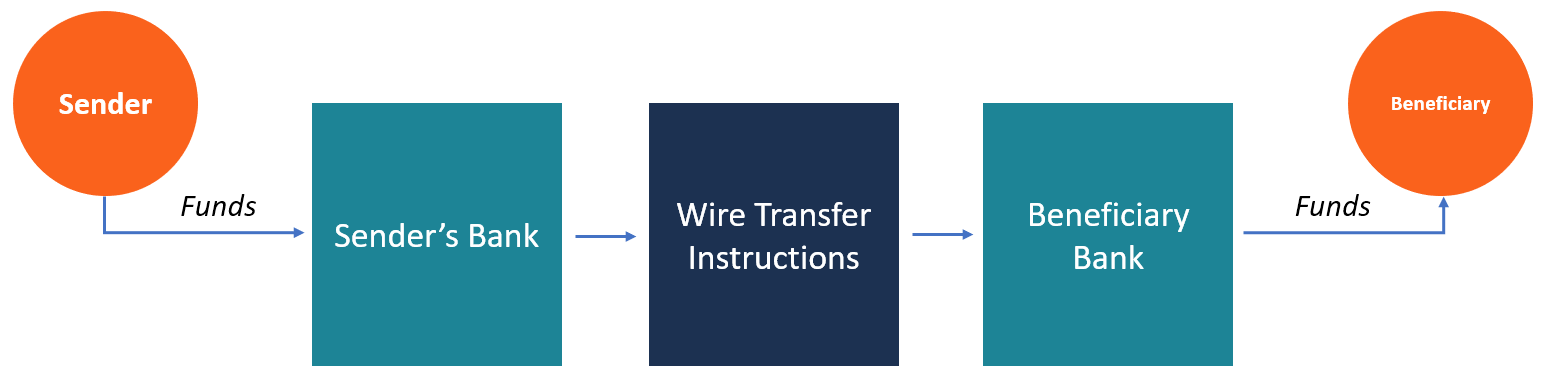

The fresh Federal national mortgage association HomeStyle repair loan was designed to provide a keen more affordable and you may easier means for home buyers, home owners, as well as traders to finance treatment and/or renovation by way of an initial financial otherwise re-finance. Brand new HomeStyle Recovery loan eliminates an effective homeowner’s should have in order to be eligible for, submit an application for, and you will close a second mortgage. In addition, it eliminates the newest troublesome twice finance that house people often have to handle when buying a fixer-upper. To take action, it profit the purchase price buying property to your cost to correct the house, all of the to the you to definitely nice package.

Federal national mortgage association HomeStyle Recovery

HomeStyle Recovery financing support an individual-closing replacement for a very common repair and treatment condition. Rather than being forced to remove the next mortgage particularly a home security financing, otherwise home security personal line of credit, homebuyers and homeowners is also to complete a comparable functions that requires are complete, most of the when you’re using an initial financial for the possessions. Zero second mortgage mode merely that have one month-to-month homeloan payment in order to care about whenever you are still being able to make required fixes you to a home needs.

Fannie Mae’s HomeStyle Repair financing lets borrowers to invest in not merely a home get or re-finance, although costs away from fixes and you can home improvements, all in one mortgage. Borrowers get utilize around 75% of the lesser between the as-finished (after rehabilitation/renovation) appraised value of your house and/or price of family plus rehabilitation /recovery costs. There are not any restrictions as to the kind of developments one can be produced towards assets, for as long as they are complete within 6 months of brand new loan’s origination.

HomeStyle Ree benefits associated with the fresh new HomeStyle and HomeReady mortgage software, including the flexible qualification criteria. Home buyers https://paydayloancolorado.net/nucla/ can also be set as little as 5% down towards fundamental loan, or step 3% whenever along with the HomeReady bundle, getting it spend personal financial insurance rates, that they is cancel once they provides built up no less than 20% collateral in their house.

How HomeStyle Renovation Loan Really works

Homebuyers and you can homeowners will find a convenient restoration services with the brand new HomeStyle recovery mortgage. In lieu of along with its opponent, the fresh new FHA 203(k) loan, there aren’t any actual constraints about what is said to be remodeled or fixed into proceeds from a good HomeStyle repair financing. Consumers usually, not, you desire a licensed builder to add detailed agreements and you will proposals for the job that is to be done to the house.

The HomeStyle Repair loan are used for people means of repair also (although not simply for) framework developments, updating a mature household, including new features to your structure, as well as building even more living spaces particularly a basement apartment or an in-legislation package. Oftentimes, performs through with the fresh new HomeStyle mortgage loan rapidly adds collateral to help you a house, a huge work with for all the homeowner. Useful home buyers may even money specific carry out-it-your self really works, delivering it does not be the cause of over ten% of the residence’s as the-done really worth.

Capital regarding HomeStyle financing is usually paid as tasks are finished, immediately after being inspected. In spite of this, it will be possible for almost all currency become paid initial from inside the order to pay for certain costs about the brand new repair, such as fees for extract one needed it allows.

The latest HomeStyle recovery mortgage was packaged since both a great 15-12 months financing, a thirty-season mortgage, otherwise a beneficial 5/step one adjustable-rate mortgage. Eligible very first-big date homebuyers may place as little as step three% to your an advance payment. The latest cancelable personal home loan insurance policies that you need getting off repayments not as much as the standard 20% is also considered cheaper than just FHA financial insurance possesses zero upfront premium.

دیدگاه خود را ثبت کنید

تمایل دارید در گفتگوها شرکت کنید؟در گفتگو ها شرکت کنید.