The thing you need Knowing Before you take Away Home financing

Purchasing a home or apartment would be frightening, particularly if you are not accustomed all the info. Home loans seems like an easy procedure, but there’s more in it than shelling out some cash and obtaining the tips right back. If you’ve currently had the new eco-friendly white from your own financial and are quite ready to start finding a property one meets your needs, this article allows you to get one thing transferring the proper guidelines. Here are four exactly what you need to know prior to taking away a mortgage

1. You’ll want to Understand Your money Models Beforehand

Earlier looking into money, it is preferable to find an obvious idea of just how much you plan towards placing off. If you’re looking to acquire a property with that loan, your advance payment is a huge reason behind the general rates of one’s exchange. Quite often, brand new faster you put down, the greater the eye you’ll shell out. Prior to you heading on the path from trying to get a loan, be sure to have an idea out-of just how much you find the money for set out. You won’t want to lay out a little, immediately after which end up with a huge interest expenses in the end. In terms of home loans, placing faster off may end upwards costing you more income when you look at the the future.

2. You want An effective Comprehension of Mortgages

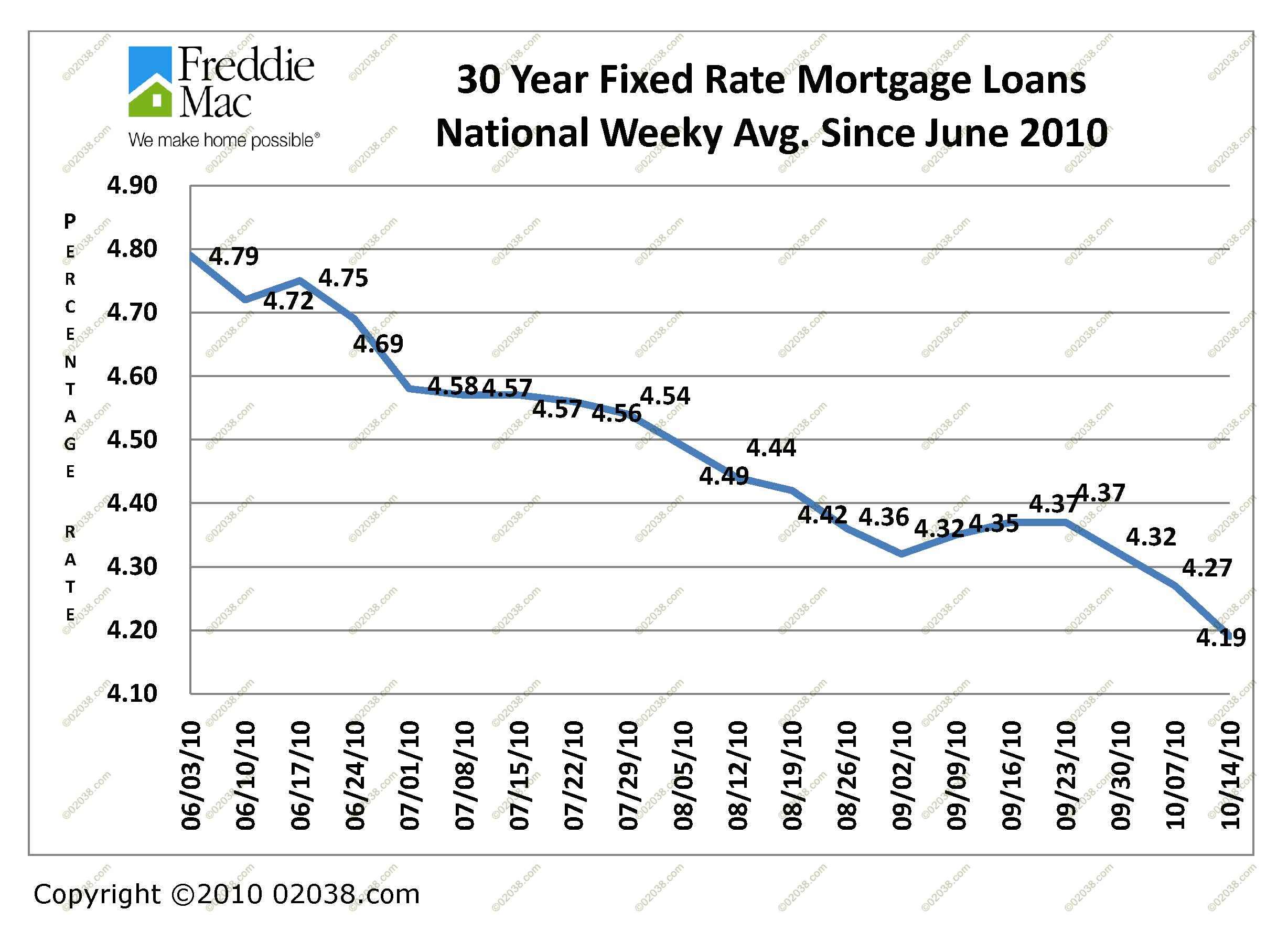

Before you get yourself started your property loan application, you want a much better knowledge of just how mortgages really works. Generally, a lender provides you with a mortgage to assist finance the fresh purchase of a home. The mortgage mortgage offers the cash to own the property and certainly will build your buy less expensive. For the a frequent mortgage scenario, you are going to obtain some cash and place they on a binding agreement with your bank.

You will then provide the bank the right to just take fingers in your home if your home worth falls underneath the amount you borrowed from into mortgage. In case there is a foreclosure, their lender takes the house straight back, and you can upcoming need to make the newest repayments into lender. When it comes to mortgages, discover different kinds of resource available. Before it is possible to make a decision, you should have a fundamental understanding of each type regarding home loan.

Purchase-money Financial: These financial is utilized when buying a different sort of domestic. You are going to generally speaking remove that it mortgage to pay for costs of the property.

step 3. Credit ratings Amount A great deal When you are To invest in Home

To invest in a property otherwise a residential property is actually a major funding. It helps your make money, you should be cautious when making it buy. Oftentimes, you happen to be financing a lot of your earnings more the class of some age. If you are not careful, to invest in a home may end upwards costing you a lot way more than just you expected. If you’re planning on the taking right out home financing, it’s important to just remember that , the financial institution might look very closely at your credit report and you can credit score whenever determining whether to approve you for a financial loan. These types of circumstances get a major affect the amount of currency youre accepted so you’re able to acquire.

You should just remember that , your credit rating plays an enormous character on your own capacity to borrow cash, so it is vital that you ensure that it stays who is fit. There are a number of something different which can feeling your own credit score.

These something were paying down old bills, keepin constantly your bank card balances lower, to make with the-time money, and you may keepin constantly your credit utilization proportion lower. The lower their borrowing use proportion the better.

4. Federal national mortgage association, Freddie Mac Therefore the Variation

Mortgage brokers are generally granted from the financial institutions and other financial institutions. Although this brand of financing are managed, the procedure can be very challenging getting a primary-day house consumer. While you are buying your basic house otherwise investing an enthusiastic apartment strengthening, you will need to understand the procedure and you may know the differences when considering different types of financial support. There are a number of different varieties of resource available whenever you are to get a home. Prior to you will be making a decision on what particular financial to get, you need to have a much better comprehension of advantages and you can drawbacks each and every brand of funding.Fannie mae and you will Freddie Mac try government-paid, mortgage-make certain associations. They offer reasonable-rates investment so you’re able to certified consumers. Mortgage insurance is expected by using a loan from Fannie Mae or Freddie Mac computer. If not build money promptly, your loan is certainly going into the default, and also the manager of the property might be settling the lender.

5. Know what Identity Covers When searching for Financing

When you are choosing on what brand of financing to carry out, you need to bear in mind precisely what the term talks about. You may realise for instance the less the greater, however, would certainly be surprised at the real difference a long or small title mortgage tends to make. Such, a thirty-year loan Tennessee installment loans for bad credit will be the quickest name offered, nevertheless will be the very pricing-effective. A 15-year loan may be the longest identity available, it tends to be more expensive. It is critical to remember exactly what the identity length talks about while searching for home financing. With regards to the style of financing you wind up taking out, a smaller label is almost certainly not once the costs-active.

six. See the Requirement for Downpayment

One of the most important things you should keep in head when taking out a home loan ‘s the deposit. Usually, just be sure to build a down-payment with a minimum of 10%. Both, lenders tend to ask for the absolute minimum advance payment regarding only a small amount as the step three%. But not, for the most part, 10% ‘s the lowest amount you need to be putting down. You don’t need to put down a good number of currency, however need to set-out something. It is important to understand that a lesser downpayment increases the monthly installments. This is because the down-payment number is actually reduced before the mortgage try fully repaid. When taking aside financing having a lesser down-payment, you will have to pay more money as your monthly premiums and can take more time to repay the loan.

دیدگاه خود را ثبت کنید

تمایل دارید در گفتگوها شرکت کنید؟در گفتگو ها شرکت کنید.