How exactly to Purchase Your own Custom home, Addition, or Restorations Project

Principal payday loan Garden City, DeMotte Architects

There are a few a method to pay for or loans their investment, and your selection are different depending on the sorts of endeavor you will be performing. In case it is a bespoke home, you have particular solutions which do not apply at other forms of programs particularly enhancements or remodels.

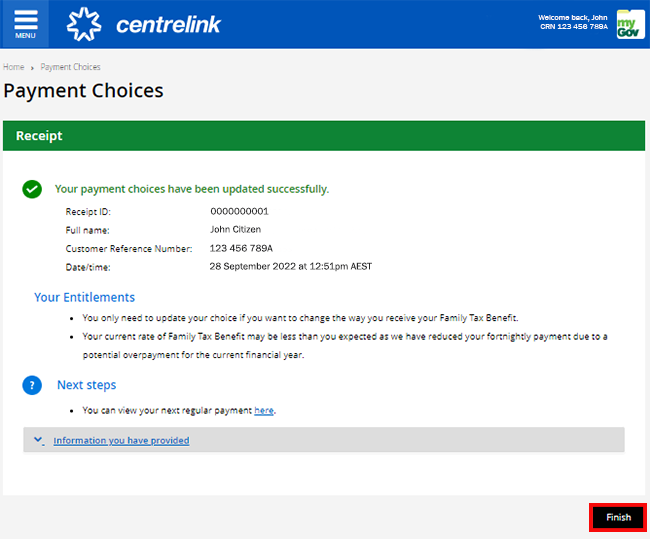

- Remark their borrowing information & make certain that its accurate.

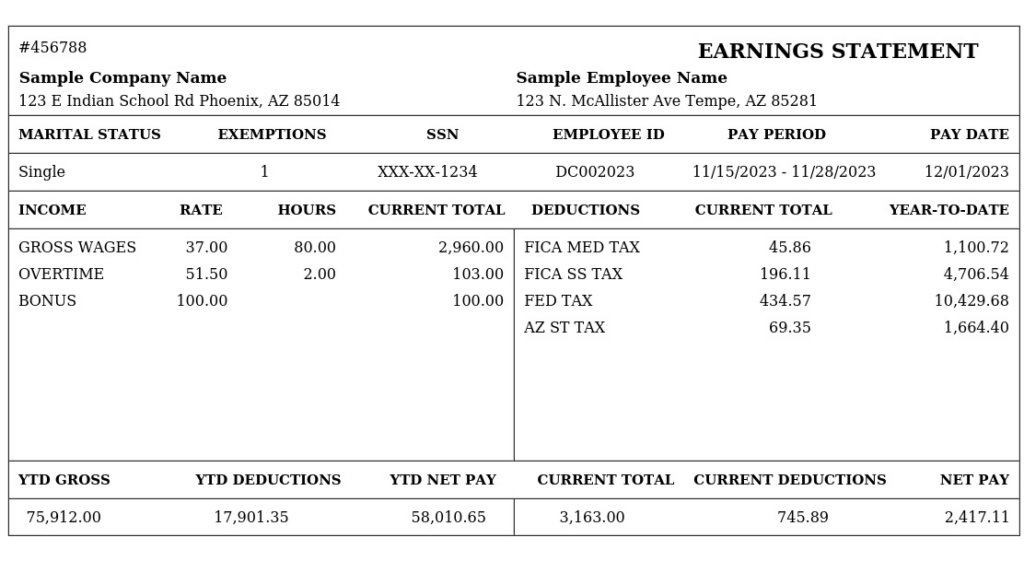

- Give documents of income, a career, 1-24 months away from Irs filings, bank account, 401k’s & other assets.

- Outline your month-to-month family expenses.

This conditions would-be accustomed dictate how much cash you could acquire & the cost of our home you really can afford.

An easy way to pay money for household methods:

The best alternative (if at all possible) should be to pay with bucks, whether or not it arises from deals otherwise personal money away from family members or trusts. That being said, I find many homeowners able to spend inside the cash favor so you can borrow money when the fund rates are reasonable, since their cash is even more wisely regularly create more money by purchasing.

Instead of much time-name mortgages, construction money is short-title loans with a payback months between a dozen-18 months, that is usually enough time to done framework. So it loan will be changed into a long term financing (mortgage) anywhere between 15-three decades.

This type of finance are typically attention-only, which have variable cost linked with the prime rates. Dont expect the bank so you can underwrite the complete project, because the lenders will need you to definitely possess some skin regarding online game. You will definitely pay an element of the can cost you (somewhere between 10-20%) to share on threat of your panels.

For individuals who currently individual the lot, the new collateral throughout the property can be integrated as part of the newest security towards the construction mortgage. For people who purchased the brand new home that have a lot financing, then the structure mortgage would be always repay and you will re-finance one basic financing. When you’re buying a lot with the design mortgage, possible enhance brand new closure toward acquisition of the fresh package with the construction mortgage closure.

The lending company have a tendency to usually like to see initial plans when you begin revealing the project together with them; following they will want a last band of design pictures. An appraisal will be over in accordance with the pictures & the bank offers financing based on the upcoming value of your house. During design, possible draw currency considering bills in the specialist, for the financial sending their particular inspector to ensure the work happening before it launch the income.

Remember that the initial bank appraisals are typically conservative, as most homes will usually appraise higher shortly after done. You may need to arranged adequate bucks at the end of one’s endeavor and also make within the change if needed.

It is that loan for the equity in the home, which is a great solution when incorporating onto or building work good home you have stayed in for a time & features built up guarantee over the years.

You may be essentially credit funds from the lending company from the value of your residence & settling the mortgage over time. Such financing obviously isn’t an option for those who purchased a house since a tear-off, just like the you would not any longer enjoys an equity inside your home; might only have guarantee from the property value the fresh residential property.

When the the main house is being spared even in the event, a creative lender you are going to enable you to start your panels which have a HELOC & following move they to help you a housing mortgage throughout design.

This can be a temporary (6-9 month) mortgage built to security the fresh pit when you’re to acquire a new home but have not offered your domestic yet, so that you do not have the cash need. You might use the money in order to upgrade your current house.

Keep in mind that such loans has actually high prices than simply a regular mortgage & some thing will get dirty should your household does not offer through to the time-limit ends.

If you’re obviously not a traditional alternative, you’ll be able to for those who have high restrictions available to choose from. When you is almost certainly not capable fund the whole opportunity by doing this, such things as products, plumbing system fittings & light fixtures can certainly be bought towards the borrowing from the bank & paid over time… just be alert to the eye rates.

Loans especially for customized homes:

If the credit rating is excellent & you have got minimal currency having a down-payment, a federal government-backed loan are your very best choices. Off money can be as lowest just like the step three.5%, having good-sized credit underwriting.

Such financing is generally your best option for those who do have more than 10-20% for a down payment. Such funds are made to feel ended up selling to help you Federal national mortgage association & Freddie Mac, do you know the regulators-chartered mega-buyers.

Down payments lower than 10% can be acceptance however, will require a top private home loan insurance advanced. Conventional underwriting laws and regulations try more strict than FHA otherwise Va finance, & financial institutions will get include their particular costs, and this boost your costs.

These mortgage does not apply at extremely personalized home mainly based by your typical company, however, you’ll apply at a big measure creator who has development a great subdivision & is doing work closely having financial institutions, home loan businesses, otherwise their own for the-house subsidiaries.

When you find yourself there may be extreme well worth in the builder-financed bundles, sometimes they aren’t one particular advantageous in terms of interest costs, charge, & the range of financing brands. It is best to look around.

The simplest way on the best way to finance your project all depends on the of many points. Research thoroughly, look around & find the best one which works for you.

Make your dream family within the CT or Nyc having DeMotte Architects.

With well over three decades feel, we have been right here to create your ideal interior planning. Contact DeMotte Architects to go over your residence redesign, inclusion, otherwise personalized new house from inside the Fairfield County CT, Westchester County New york, and related communities.

دیدگاه خود را ثبت کنید

تمایل دارید در گفتگوها شرکت کنید؟در گفتگو ها شرکت کنید.