Tips finance a little house with a consumer loan

The rate

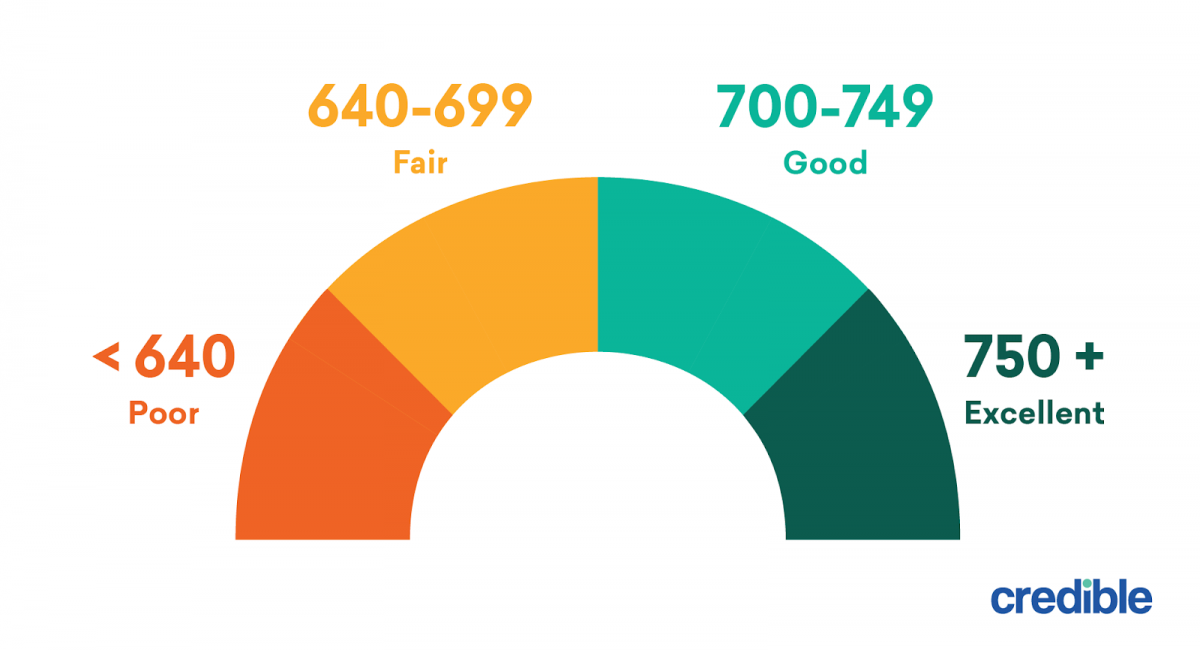

Even though you enjoys a reduced credit score, you can likely find a loan provider so you’re able to accept your little household investment. The newest tradeoff might be increased rates of interest. These cost increases their monthly installments, borrowing from the bank can cost you, otherwise one another.

As you contrast mortgage has the benefit of, calculate the full cost of the loan over time. When it is over you are comfortable investing in their smaller domestic, consider waiting to finance unless you is qualify for a better rate.

Your budget

A different consideration is simply how much you really can afford to spend monthly. Look at the money and you may expenditures to see how much go room you have got to have a property commission. Up coming weigh you to definitely up against exactly how your financial allowance may differ immediately after swinging in the little household.

In case your budget is stretched narrow, funding a small domestic is almost certainly not a smart move just yet ,. But investment might make experience as much as possible swing the added payment-of course your own living expenses drop-off immediately following you’re in the little house.

Your upcoming needs

Are you embracing tiny domestic life into the long lasting, or is they a temporary plan? For individuals who end up in aforementioned go camping, do you have an escape means? What goes on along with your tiny family-and your investment-if you real time someplace else?

Before you could finance a little home, you should envision the decision commonly affect you off the fresh line. You will need a timeless domestic in the next couple of years, eg, and taking right out an enormous mortgage today can make they more complicated to qualify for home financing later on.

Money have much time-name borrowing from the bank impacts, therefore it is not necessarily how you can method an initial-title problem. Take to the little domestic seas very first (you could book one getting a week-end, like) in advance of entering into that loan contract.

Funding a little house with a personal loan is usually good quick and easy techniques, particularly compared to the trying to get home financing. And since you are not taking out a home loan, zero advance payment are involved. This is how it functions:

- Look at zoning statutes and helping. Their city’s otherwise county’s planning department will show you exactly what zoning rules commonly affect your lightweight domestic, just what it allows you need, and you can what those people it permits costs.

- Determine how much you will have to use. You might estimate your perfect loan amount knowing just how much it is possible to pay for it allows. Definitely reason for more will cost you, including equipment, shorter seats, and you will belongings improvements-instance, creating a septic system.

- Check around. Before applying, prequalify having about four lenders. (It constantly merely requires one to three minutes to find preapproved.) Contrast the loan also offers, and select the only toward top cost and terms and conditions.

- Make an application for the loan. Immediately after going for that loan render, it is possible to complete a full application with this lender.

After you’ve complete the lender’s confirmation techniques and you may acquired final recognition, your own lender have a tendency to disburse the loan, most often towards family savings. In some instances, same-big date or second-time money is available.

To find the best shot from the fast resource, use prior to regarding the week and you can earlier in the day. For people who apply to six p.yards. on the a Discover More Here friday, including, you most likely won’t get your funds till the adopting the Monday otherwise Monday.

How come installment manage loans to possess lightweight house?

Paying your small financial is like paying virtually any variety of mortgage: It is possible to spend a set count every month up to your loan is actually fulfilled, whether or not very lenders will let you generate even more, principal-only repayments so you’re able to speed the loan rewards.

Your payment depends on the speed your qualify for, the loan proportions, as well as your payment months. Having ease, we will guess you’ve got best that you advanced borrowing from the bank and want good $50,000 lightweight home loan. This is how different conditions and you will prices can impact their percentage:

دیدگاه خود را ثبت کنید

تمایل دارید در گفتگوها شرکت کنید؟در گفتگو ها شرکت کنید.