Bank card Liability, Obligation, and you may Revelation Operate regarding 2009

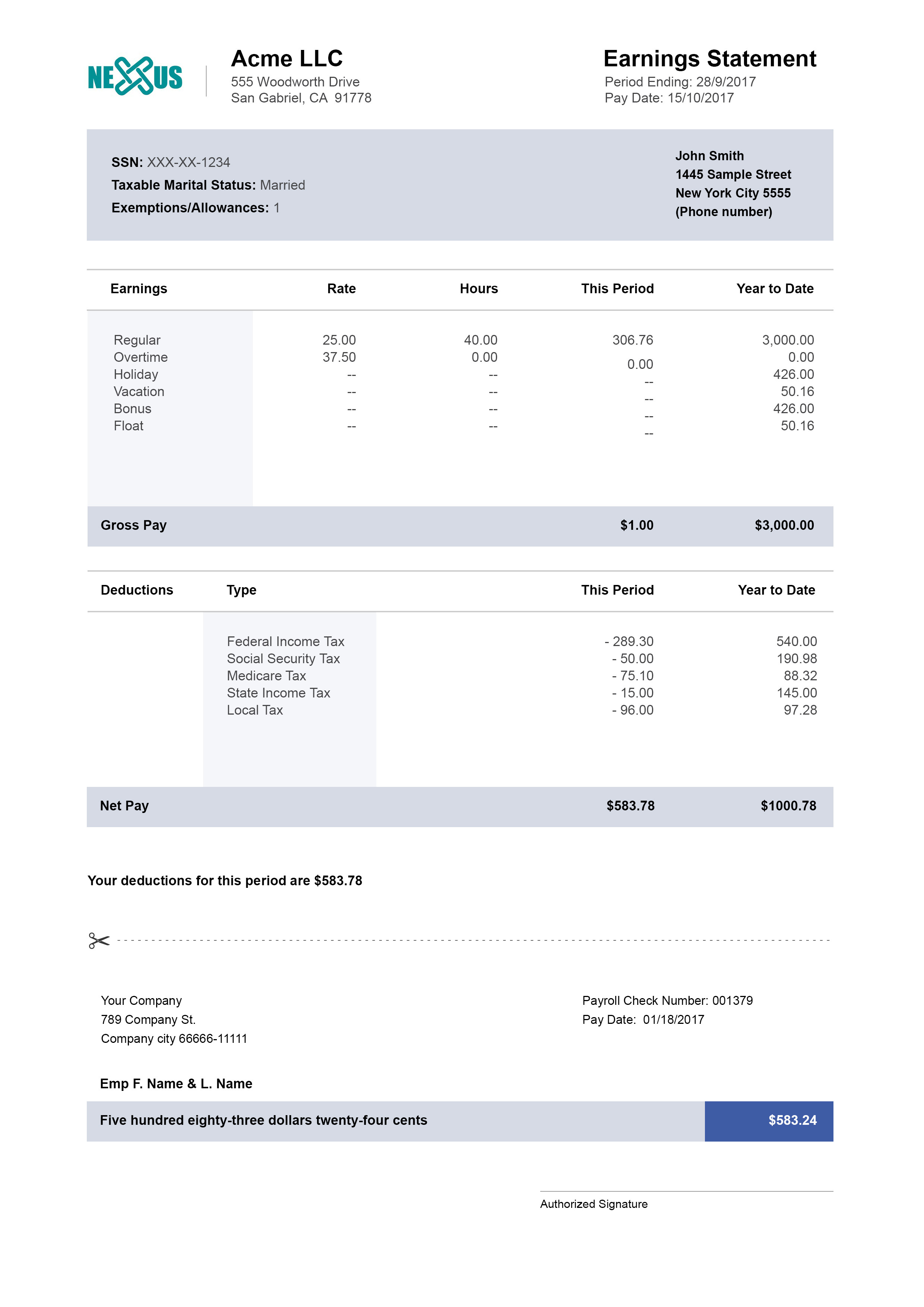

Of the demanding that the funds charges and also the annual percentage rate become announced into the a beneficial uniform basis, the brand new TILA can make information and you can assessment from fund convenient. The new fund charges The entire cost of credit a consumer need certainly to spend on the a personal bank loan, as well as desire. ‘s the complete of all of the money covered borrowing; it offers the interest paid back along side lifetime of the mortgage and all of running costs. New annual percentage rate ‘s the correct interest rate getting money or credit actually available to the latest borrower. The fresh new annual percentage rate need to be calculated by using the total finance costs (also all of the most fees). Discover Shape nine.step 1 “Borrowing Revelation Form” to possess a good example of a great revelation mode employed by financial institutions.

Consumer Rental Operate off 1988

An individual Leasing Work (CLA) amends the new TILA to include equivalent complete revelation to own people whom rent trucks or other goods out-of firms whoever company it is to help you rent particularly products, should your products are appreciated at the $25,000 otherwise faster additionally the lease is for four months or far more. Most of the point regards to new book need to be disclosed on paper.

Before law went towards the feeling, the businesses-in general commentator put it-unleashed a great frenzy regarding retaliation, Liz Pulliam Weston, Charge card Loan providers Go on a Rampage, MSN Money,

From inside the 1989, this new Reasonable Credit and you may Bank card Revelation Operate ran on the impression. That it amends the newest TILA by demanding credit card issuers to reveal from inside the a beneficial uniform fashion the fresh new apr, annual charges, grace months, or other information regarding mastercard applications.

This new 1989 work performed to allow users to know the expenses with the mastercard explore, but the cards companies’ decisions over 20 years sure Congress one to far more control try requisite. In 2009, Congress enacted and you may President Obama finalized the credit Credit Responsibility, Obligation, and you can Revelation Work regarding 2009 (the credit Credit Work). It is a deeper amendment of one’s TILA. A number of the salient elements of the operate are listed below:

- Limits the interest rate increases within the first year, with many conditions. The purpose is to abolish teaser costs.

- Develops see having speed increase on the future commands so you can forty five days.

- Saves the ability to pay back to the old words, which includes exceptions.

- Limitations charge and you will penalty desire and requires comments so you’re able to demonstrably county the required due date and later commission penalty.

- Means reasonable application of money. Wide variety in excess of minimal payment must be put on the highest interest (with some exceptions).

- Brings sensible due dates and you will time for you spend.

- Covers younger consumers. Before giving a card to help you one according to the ages of twenty-that, this new card issuer have to get an application which has had possibly the newest signature out-of loans in Louviers a cosigner avove the age of twenty-you to or pointers exhibiting an independent manner of repaying any credit stretched.

- Limitations card providers regarding delivering concrete gift suggestions in order to people towards the university campuses in exchange for completing credit cards application.

- Requires colleges to publicly divulge one revenue agreements made out of a great card company.

Creditors which violate this new TILA try subject to one another criminal and municipal sanctions. Ones, the initial will be municipal remedies offered to people. In the event that a creditor does not disclose the desired guidance, a buyers can get sue to recover twice the fresh financing costs, along with legal costs and you will practical attorneys’ fees, with a few limits. From what Bank card Act away from 2009, the latest issuing companies weren’t pleased with brand new reforms. by repricing customers levels, switching repaired rates to help you adjustable costs, lowering credit limitations, and broadening charge.

دیدگاه خود را ثبت کنید

تمایل دارید در گفتگوها شرکت کنید؟در گفتگو ها شرکت کنید.