What is actually well-known anywhere between Inflation, Sub-Perfect Home Security, and cost-Using?

KPMG | Management Asking | DTU | IIM Udaipur

Fundamentally some body believe that rising prices is like friction, a wicked but a necessary one to. So it results in decline of the to purchase electricity.

However, did you realize, sometimes, Rising cost of living boosts the property value the fresh new assets that you individual? Such as – A home.

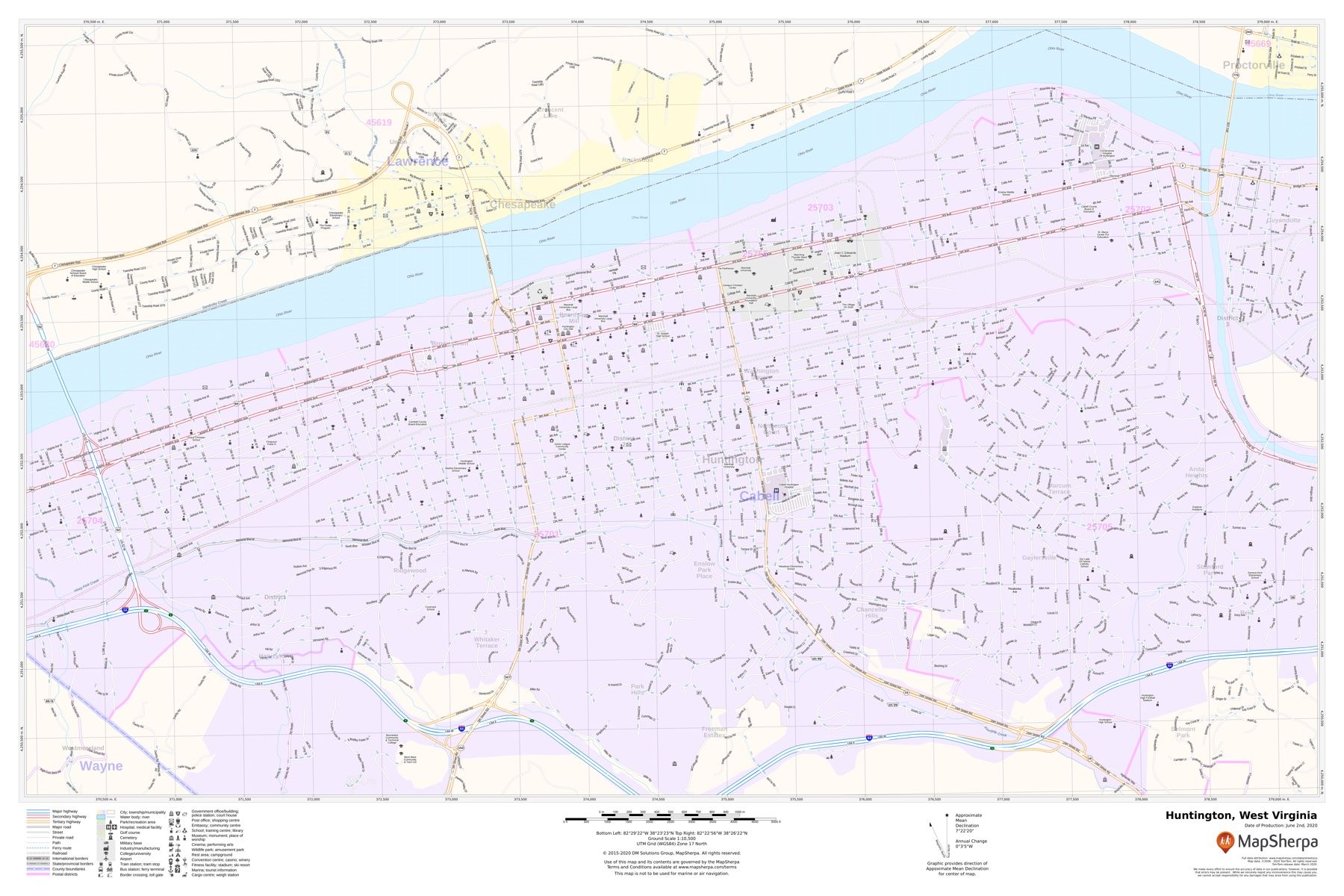

Today, whenever we glance at the case of the united states earlier was hit by 2008 sandwich best financial crisis, everybody was happier; the lenders was happier, the newest borrowers were happy.

The inflation within the genuine advantage cost leftover raising the costs out-of the fresh homes, hence thus (and since out of most other reasons hence I shall simply define), already been getting used given that domestic collateral, that means one could get huge loans foundation mortgaging the domestic this one lived in and you may didn’t manage to dump, never mind new installment possibilities.

As a consequence of modern world and also the capitalism caused finances motive (rather than in a few organizations instance Horsepower the spot where the senior management felt like that everyone would just take pay-slices to store the task losings in check) some one become providing put-out of thin earnings of the center/employee classification in the us come stagnating (indeed toward a low highway once changing to have inflation) on later 70’s. ادامه مطلب