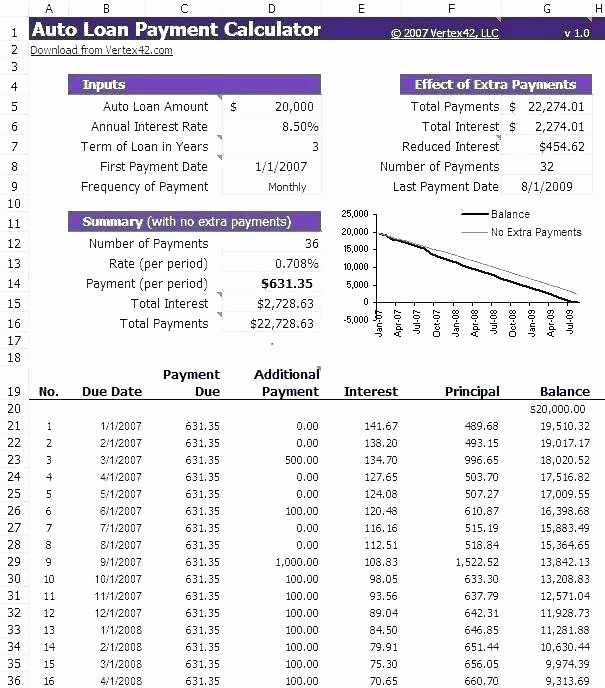

Making use of 401(k) funds to repay home financing very early leads to shorter full focus paid on the lender throughout the years

Removal of Attract

Another advantage off withdrawing funds from an effective 401(k) to pay off home financing harmony are a prospective reduction in attention payments so you can a lending company. For a traditional 31-12 months financial for the an effective $200,000 household, of course good 5% repaired interest rate, full interest payments equivalent a bit over $186,000 along with the prominent harmony.

However, so it advantage is most effective if you’re rarely to your financial name. If you find yourself alternatively deep on make payment on home loan of, you probably already reduced the bulk of the attention you owe. That is because settling appeal was front-stacked over the label of the loan. Explore a mortgage calculator observe exactly how this may browse. ادامه مطلب